Electric cars are becoming increasingly popular, but there are still many people who are unsure about what they are and how they work. One of the most common questions is “what does tax liable mean for electric cars?” Under current law, electric cars are subject to the same taxes as any other vehicle. This includes things like registration fees, license plate fees, and gas taxes. However, there are a few states that have enacted laws that exempt electric cars from some or all of these taxes. The most common reason for this is to encourage people to switch to electric cars. By exempting them from taxes, it makes them more affordable and thus more attractive to buyers. This can help to reduce pollution and dependence on fossil fuels, which is good for the environment and the economy. It’s important to note that tax liability for electric cars can vary depending on the state in which you live. So, if you’re considering buying an electric car, be sure to check the laws in your state to see if you’ll be exempt from any taxes.

The government of the United States has a program that encourages the purchase of electric vehicles (EVs). Since 2010, new EV purchasers have been eligible for a $7,500 tax credit. The credit is not available on standard hybrids. Tesla and General Motors have not been included in the credit program in the past. If you claim a tax credit, you may be able to reduce your tax liability by up to $7,500 for the year. The tax credit you receive will not be immediately refunded to you. Certain states, in addition to requiring Native Americans to obtain special permits, allow them to use state roads.

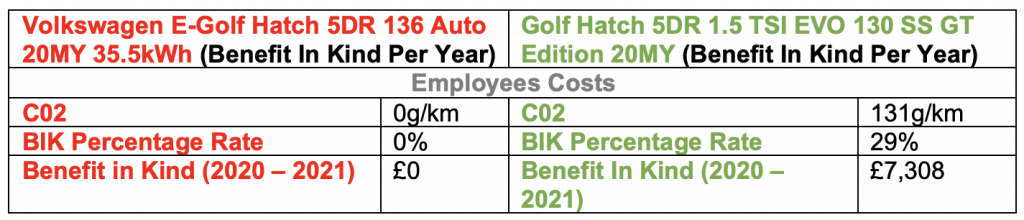

During 2020 and 2021, Benefit in Kind (BIK) will not be taxable for hybrid vehicles with emissions ranging from 0 to 50g/km and a pure electric range of more than 130 miles. The electric car tax will increase to 1% in 2021 / 2022 and 2% in 2022.

The 100% first year allowance (FYA) for pure zero emission vehicles will be available for new and used vehicles beginning on April 1, 2021. 100% FYA will also apply to zero emission vehicles purchased new or unused before April 1, 2021.

Yes, you read that correctly: if you buy a fully electric vehicle between 2022 and 2023, you do not need to pay any money in road tax. To encourage the purchase of zero-emission vehicles, the Government has recently implemented a program that offers zero road tax rates on new vehicles.

How Are Electric Vehicles Taxed?

Electric vehicles are taxed in a variety of ways, depending on the country. In the United States, electric vehicles are subject to a federal tax credit of up to $7,500, as well as state and local incentives. In the United Kingdom, electric vehicles are exempt from vehicle excise duty, and in Norway, they are exempt from both value-added tax and registration fees.

Excise Duty (VED) is calculated by taking CO2 emissions from your vehicle, the list price of the vehicle, and the year you purchased it. Those vehicles that emit less than zero emissions are exempt. Plug-in hybrids (PHEVs) are exempt from VED. The Premium Rate is available to vehicles worth more than £40,000. The VED fee will be added in addition to the VED fee for the first five years of ownership. If you have a BEV, you will not have to pay this rate. On April 6, 2021, the vehicles must be registered. Even if you are exempt from paying taxes on your car, it must be taxed.

What Does Ev Tax Credit Mean?

To encourage EV purchases, a federal credit is available. The government provides a tax credit of up to $7,500 for residents who meet income requirements and purchase a vehicle with a price, battery, and assembly restrictions that are within these limits.

Consumers who buy electric vehicles are eligible for a tax credit from the United States government. Electric cars emit zero greenhouse gases or pollution because they emit zero emissions. In order to receive a federal tax credit, buyers of new electric vehicles must spend between $2500 and $7500. If you want to claim the EV tax credit when filing your federal tax return, you must do so. The credit can be applied to the AMT (alternative minimum tax) as well as to the general tax credit. You should also look into local rebate programs. Electric vehicles not only benefit the environment in addition to being extremely useful, but they are also appealing to a large number of buyers.

Electric cars typically have a higher price tag, whereas hybrids are typically only available for $1500 or less. Hydrogen fuel cell vehicles can receive a $5,000 rebate in California as part of a program. Businesses are also eligible for a variety of other tax credits, including state and local sales tax breaks.

Consumers should be aware that the EV tax credit is an important incentive to purchase an electric vehicle. The maximum credit is $7,500 for a car with a gross vehicle weight of less than 14,000 pounds and a battery that can produce at least 4 kilowatt hours. This credit is available to new cars purchased after December 17, 2017, and before January 1, 2023. With the extension of the EV tax credit, electric car buyers can now take advantage of it. A tax credit for electric vehicles will be extended, which is very welcome news for consumers.